On 5 June, 2021, the ministers of finance and central bank governors of the Groupe of Seven (G7), representing the main economies in the western world, expressed their commitment to work together “to build a safe, resilient and open global economic system.” The listed elements of this global cooperation include:

- Fostering a strong, sustainable, balanced and inclusive global recovery that builds back better and greener from the Covid-19 pandemic.

- Transformative efforts to tackle climate change and biodiversity loss (i.e. a push for a greener economy).

- Continuous efforts to support low-income countries.

- “Shaping a safe and prosperous future for all.” This last objective includes a preliminary agreement on an issue that has eluded international economists and diplomats for decades: the taxation of corporate activities.

A race to the bottom

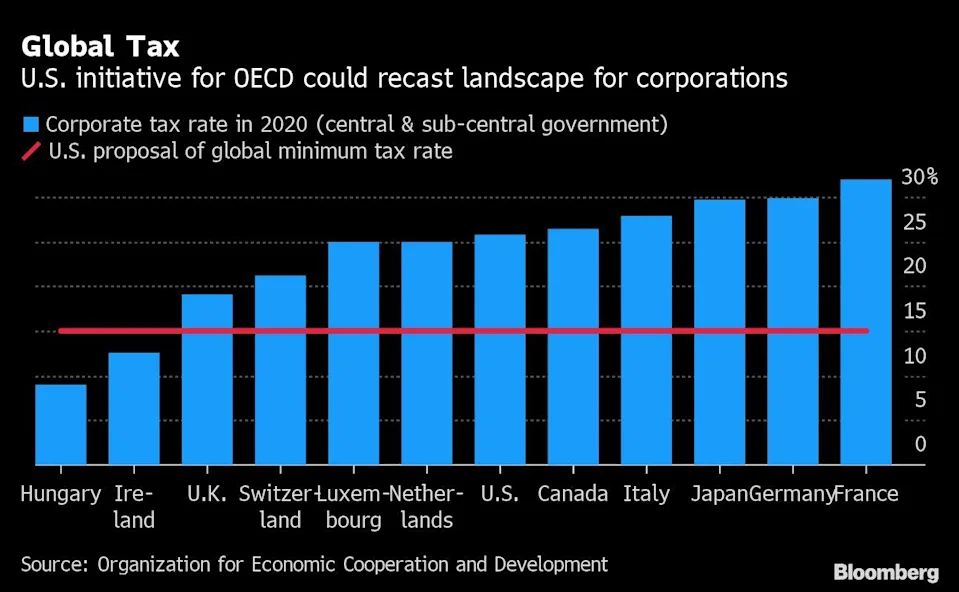

Taxation is a sensitive issue, in an almost borderless global economy where goods and services are easily sold from one country to another. This situation has created a “race to the bottom”, where some countries endeavour to attract private companies to be based in their jurisdiction in exchange for low taxation rates or other fiscal advantages, such as all sorts of exemptions. Currently, the regular basic corporate tax rate among the G7 countries is 19% in the U.K., 26% in the U.S., 27% in Canada, 28% in Italy, 30% in Japan and Germany and 32% in France. If one includes additional European countries, the spectrum is even wider:

In addition, there are further distortions if one considers such elements as “tax holidays”; different tax rates depending on whether the goods are exported or for the domestic markets; special treatments for copyrighted and intangible goods: how do you tax the viewing on a television set in France of a Netflix movie produced in the U.S. but distributed in Europe through a subsidiary in Ireland? We are confronted with a maze of regulations where some companies, helped by clever accountants and lawyers, “optimize” their taxes, which means they structure their businesses in order to pay as little as possible.

A significant step forward

Policymakers around the world have long been aware of this situation but disagreed until recently on the right approach to tackle the problem. In the absence of progress France had even started to tax large American companies that sold their products on its territory, often from a subsidiary based in Ireland. This of course created a negative reaction in the U.S. and retaliatory duties on French exports to America. No progress was made under the Trump administration because the different schemes under discussion would have penalized large American companies including the GAFAM (Google, Apple, Facebook, Amazon, Microsoft). The Biden administration, which has a more multilateral vision (and does not want to alienate Europe at a time it considers China as its main rival), took a significant step forward when the U.S. Treasury Secretary, Janet Yellen, proposed the creation of a taxation floor of 15% for large corporate multinationals. As stated in the G7 Finance Ministers Central Bank Governors communiqué: “We strongly support the efforts underway through the G20/OECD (Organisation for Economic Co-operation and Development, editor’s note) […] to address the tax challenges arising from globalisation and the digitalisation of the economy and to adopt a global minimum tax. We commit to reaching an equitable solution on the allocation of taxing rights, with market countries awarded taxing rights on at least 20% of profit exceeding a 10% margin for the largest and most profitable multinational enterprises. We will provide for appropriate coordination between the application of the new international tax rules and the removal of all Digital Services Taxes, and other relevant similar measures, on all companies. We also commit to a global minimum tax of at least 15% on a country by country basis.”

More hurdles ahead

Some key points from this historical but preliminary agreement should be kept in mind:

- The goal is to establish de facto a minimum corporate tax of 15% on a country by country basis but, presumably, there could be special arrangements within each jurisdiction and, at this stage, there is no calendar for implementation.

- The G7 Finance Ministers agreed on a framework: the basic principle is that countries in which goods from overseas are sold will be entitled to a compensation from countries where transactions are booked; this compensation, however, could be limited (20% of “booked” profits if the margin exceeds 10%) and the (very complex) details still need to be worked out.

- In the United States, the initial reaction of companies active in e-commerce like Facebook and Google has been encouraging, as they realize they will have to pay more taxes but certainty is important for planning and they will remain hugely profitable. If, however, a two third majority is needed in the U.S. Senate to pass a new treaty, chances of approval currently appear slim; it is thus possible the U.S. may adopt some but not all provisions of a new broad OECD Agreement.

- In Europe, jurisdictions which take advantage of the current tax system were not represented at the G7 June meeting and may constitute roadblocks; such foot draggers could include Ireland, Luxembourg or the Netherlands.

The next step in the implementation process, in parallel to ongoing “technical discussions” at the OECD, will be the G20 meeting scheduled in Rome on 30 and 31 October. It will then be possible to see if the framework accord reached in June could become an international binding agreement. Stay tuned…

This post gives the views of its author, not the position of ESCP Business School.

License and Republishing

The Choice - Republishing rules

We publish under a Creative Commons license with the following characteristics Attribution/Sharealike.

- You may not make any changes to the articles published on our site, except for dates, locations (according to the news, if necessary), and your editorial policy. The content must be reproduced and represented by the licensee as published by The Choice, without any cuts, additions, insertions, reductions, alterations or any other modifications.If changes are planned in the text, they must be made in agreement with the author before publication.

- Please make sure to cite the authors of the articles, ideally at the beginning of your republication.

- It is mandatory to cite The Choice and include a link to its homepage or the URL of thearticle. Insertion of The Choice’s logo is highly recommended.

- The sale of our articles in a separate way, in their entirety or in extracts, is not allowed , but you can publish them on pages including advertisements.

- Please request permission before republishing any of the images or pictures contained in our articles. Some of them are not available for republishing without authorization and payment. Please check the terms available in the image caption. However, it is possible to remove images or pictures used by The Choice or replace them with your own.

- Systematic and/or complete republication of the articles and content available on The Choice is prohibited.

- Republishing The Choice articles on a site whose access is entirely available by payment or by subscription is prohibited.

- For websites where access to digital content is restricted by a paywall, republication of The Choice articles, in their entirety, must be on the open access portion of those sites.

- The Choice reserves the right to enter into separate written agreements for the republication of its articles, under the non-exclusive Creative Commons licenses and with the permission of the authors. Please contact The Choice if you are interested at contact@the-choice.org.

Individual cases

Extracts: It is recommended that after republishing the first few lines or a paragraph of an article, you indicate "The entire article is available on ESCP’s media, The Choice" with a link to the article.

Citations: Citations of articles written by authors from The Choice should include a link to the URL of the authors’ article.

Translations: Translations may be considered modifications under The Choice's Creative Commons license, therefore these are not permitted without the approval of the article's author.

Modifications: Modifications are not permitted under the Creative Commons license of The Choice. However, authors may be contacted for authorization, prior to any publication, where a modification is planned. Without express consent, The Choice is not bound by any changes made to its content when republished.

Authorized connections / copyright assignment forms: Their use is not necessary as long as the republishing rules of this article are respected.

Print: The Choice articles can be republished according to the rules mentioned above, without the need to include the view counter and links in a printed version.

If you choose this option, please send an image of the republished article to The Choice team so that the author can review it.

Podcasts and videos: Videos and podcasts whose copyrights belong to The Choice are also under a Creative Commons license. Therefore, the same republishing rules apply to them.