Emmanuel Faber’s dismissal from his position as CEO of the food-products global giant Danone sounds like a punishment: is it possible to lead a large group along the path of sustainable development without displeasing shareholders? To what extent does his dismissal have to do with sustainability concerns?

As soon as the Danone group published its press release, the observation was quite simple for most of the economic press: the shareholders of a group are ready to move towards greater sustainability and to put forward ESG (environmental, social and governance) criteria… as long as this does not jeopardise the financial performance of the company! However, to implement a policy aligned with the UN’s sustainable development goals (SDGs), a company must necessarily commit money, which will therefore impact its short-term performance. Danone’s shareholders therefore faced criticism for two things: on the one hand, for not having had the patience to wait for medium-term performance from a societal and environmental policy; on the other hand, for not having been able to see beyond the quest for financial profitability alone.

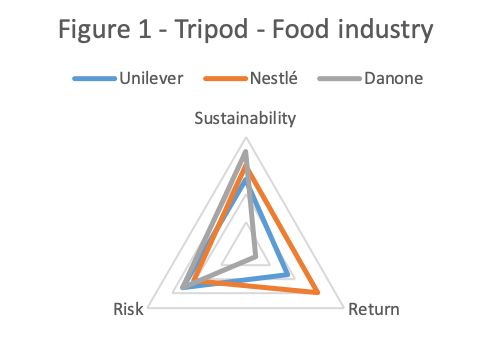

The risk-return-sustainability tripod shows sustainability concerns did not play much of a role in the shareholders’ decision to dismiss Emmanuel Faber.

Some shareholders seek to maximise their profits, according to the risk-return ratio, without worrying about any other criterion (we can call them “maximisers”); in contrast, other investors are prepared to include a third environmental and societal dimension in their choices. This means that this latter category no longer reasons solely on the basis of risk-return, but rather seeks the balance of a risk-return-sustainability tripod. In other words, this category of investors can accept a lower profitability if this is compensated for by more ESG-oriented projects (we can call them “optimisers”).

In the case of Danone, the activists did not particularly criticise Emmanuel Faber for his strategies towards more sustainability. They focused their arguments on the group’s poor financial performance compared to that of its two main competitors:

- For profitability, Danone’s share price had risen by only 8% over the last five years, compared to +34% for Unilever and more than 58% for Nestlé (including dividends).

- For risk, we use a classical measure of volatility in finance, i.e., the standard deviation of monthly returns for Danone, Unilever and Nestlé shares over the same five-year period.

- Finally, for the corporate sustainability criterion, we refer to the rating established by MSCI ESG ratings on a sample of 2,800 companies. On this last criterion, Danone is the best ranked of the three companies: it obtains an AAA rating, i.e., the best rating on a 7-level scale (see Figure 1).

The differences are small in terms of risk and ESG rating. Profitability is where we see major differences. In the logic of a balanced tripod, one would expect the three triangles to occupy roughly the same area. In other words, an ESG deficiency for a company should be offset by better profitability, while a company active in sustainability might have a lower profitability, but probably also a lower risk. The idea of the tripod is precisely that of compensation and balancing between the three criteria.

In practice, Danone’s triangle is much smaller (in terms of surface area) than that of the other two groups: despite a better environmental performance, and at roughly the same level of risk, the group has much lower profitability than the other two companies. In fact, if we only focus on Danone’s history, the sustainability axis does not bring much added information: even in a classical risk-return trade-off, Danone generates much less profitability than its main competitors, for approximately the same level of risk. In other words, and as opposed to what has been said in the press, sustainability concerns did not play much of a role in the shareholders’ decision to dismiss Emmanuel Faber.

Comparatively, Unilever has a lower ESG rating than Danone but its triangle is more balanced. And the ideal company seems to be Nestlé: for a high level of profitability, it also shows a lower level of risk, and a very good sustainability rating.

No excuse

The introduction of a sustainability criterion not only allows for a better understanding of the choices of different shareholder segments, but also enables us to debunk certain myths, for example the opposition between ESG concerns and shareholders’ demand for maximized profitability. Indeed, in some cases like Danone, a strong commitment to sustainability is no excuse for a poor financial performance.

We successfully applied this tripod to map the different shareholder segments in the automotive industry and their concerns, as well as to see if it could be generalised to other sectors. If a company chooses to give priority to one of the three parameters, then it will probably change the equilibrium of this risk-return-sustainability tripod as compared to its main competitors, and attract shareholders whose interests are the most aligned with this new configuration.

The views expressed in this article, which is based on the impact paper originally written as part of the “Better Business: Creating Sustainable Value” series, are those of the author alone and not the position of ESCP Business School.

License and Republishing

The Choice - Republishing rules

We publish under a Creative Commons license with the following characteristics Attribution/Sharealike.

- You may not make any changes to the articles published on our site, except for dates, locations (according to the news, if necessary), and your editorial policy. The content must be reproduced and represented by the licensee as published by The Choice, without any cuts, additions, insertions, reductions, alterations or any other modifications.If changes are planned in the text, they must be made in agreement with the author before publication.

- Please make sure to cite the authors of the articles, ideally at the beginning of your republication.

- It is mandatory to cite The Choice and include a link to its homepage or the URL of thearticle. Insertion of The Choice’s logo is highly recommended.

- The sale of our articles in a separate way, in their entirety or in extracts, is not allowed , but you can publish them on pages including advertisements.

- Please request permission before republishing any of the images or pictures contained in our articles. Some of them are not available for republishing without authorization and payment. Please check the terms available in the image caption. However, it is possible to remove images or pictures used by The Choice or replace them with your own.

- Systematic and/or complete republication of the articles and content available on The Choice is prohibited.

- Republishing The Choice articles on a site whose access is entirely available by payment or by subscription is prohibited.

- For websites where access to digital content is restricted by a paywall, republication of The Choice articles, in their entirety, must be on the open access portion of those sites.

- The Choice reserves the right to enter into separate written agreements for the republication of its articles, under the non-exclusive Creative Commons licenses and with the permission of the authors. Please contact The Choice if you are interested at contact@the-choice.org.

Individual cases

Extracts: It is recommended that after republishing the first few lines or a paragraph of an article, you indicate "The entire article is available on ESCP’s media, The Choice" with a link to the article.

Citations: Citations of articles written by authors from The Choice should include a link to the URL of the authors’ article.

Translations: Translations may be considered modifications under The Choice's Creative Commons license, therefore these are not permitted without the approval of the article's author.

Modifications: Modifications are not permitted under the Creative Commons license of The Choice. However, authors may be contacted for authorization, prior to any publication, where a modification is planned. Without express consent, The Choice is not bound by any changes made to its content when republished.

Authorized connections / copyright assignment forms: Their use is not necessary as long as the republishing rules of this article are respected.

Print: The Choice articles can be republished according to the rules mentioned above, without the need to include the view counter and links in a printed version.

If you choose this option, please send an image of the republished article to The Choice team so that the author can review it.

Podcasts and videos: Videos and podcasts whose copyrights belong to The Choice are also under a Creative Commons license. Therefore, the same republishing rules apply to them.