With the intention to share their research with a wider public, from students to experienced professionals, Kartik Chawla, Martina Macpherson and Daniel Ung explore the impact of sustainable investment approaches on investment decision-making, with a focus on the analysis of controversies at corporate and sovereign levels, and discuss potential performance implications and trade-offs. The insights come from the chapter “Analysing ESG policy, market and portfolio construction considerations in investment portfolios” in the newly published ESG Investing and Analysis: A Practitioner’s Guide (RiskBooks, 2022).

Over the last two decades, investors have increasingly considered environmental, social and governance (ESG) criteria within their investment decisions to meet their varying expectations, such as using ESG as an expression of personal ethics and values, as a means of downside risk protection in the investment portfolio, or as a new source of investment alpha. New regulations, such as the European Union Sustainable Finance Disclosure Regulation, have mandated that investment managers classify and disclose their sustainability risks.

According to the Global Sustainable Investment Alliance (GSIA), the size of the sustainable investment market is approximately US$35.3 trillion. It is estimated to reach US$53 trillion by 2025 (Bloomberg Intelligence, 2021). Much of the growth has emanated from North America and Europe. Alongside the growing interest in ESG, a vast array of ESG regulations have been initiated around the world. The Principles for Responsible Investment reports that there are now more than 750 policy tools and guidance frameworks globally, including 159 new or revised ESG policy instruments.

Incorporating the ESG – the extra-financial insights in investment analysis are still novel to many investors and can be challenging because of the often-conflicting opinions provided by ESG providers and differences in government policies and ambitions.

What you should know when considering sustainable investments

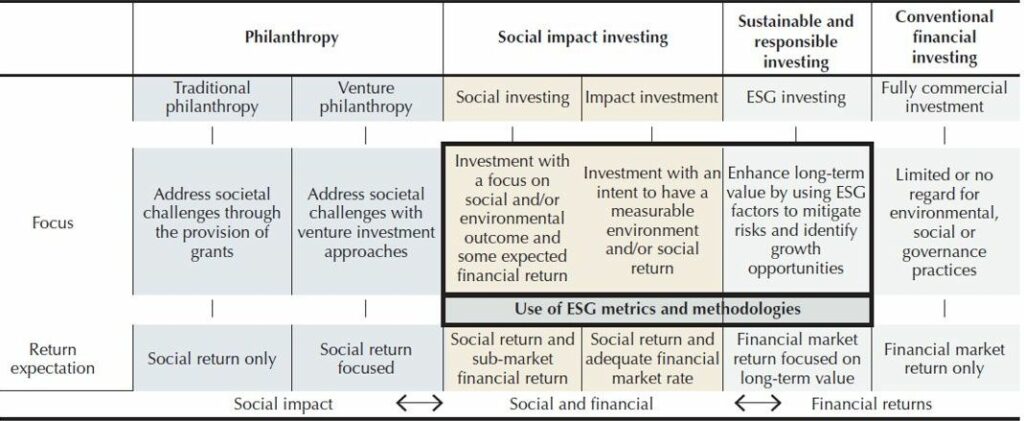

When it comes to investment portfolio construction, one size does not fit all, and sustainable investing is ultimately an all-inclusive category encompassing a broad range of strategies. There are traditional “finance-first” strategies that focus mainly on maximising shareholder value, absolute or risk-adjusted returns, and centring around the efficiency of capital markets. Meanwhile, strategies such as philanthropy and social impact investing aim to enhance the welfare of segments of society, particularly in relation to human and worker rights, gender equality and climate change, among other social considerations.

What drives the growth of sustainable investing?

The tremendous growth in sustainable investing can be attributed to a change in investor mindset through an increase in awareness of social issues, evolving expectations and a changing regulatory landscape. Another reason for the impressive growth in ESG investments is increasing demand from retail investors.

Meanwhile, policy tools globally are aimed at promoting not only ESG investments but also the data quality of ESG ratings against which many investments are measured. The regulatory scrutiny in relation to ESG data quality and rating methodologies has gathered pace, especially since the publication of the International Organization of Securities Commissions (IOSCO) report on “ESG Ratings and Data Products Providers”. This development contributed to the announcement by the European Securities and Markets Authority (ESMA) that aims to tackle greenwashing and promote transparency in ESG and credit ratings. There is also a growing push by regulatory authorities to develop “universal” ESG reporting and disclosure standards for both corporates and investors.

Types of sustainable investment strategies available

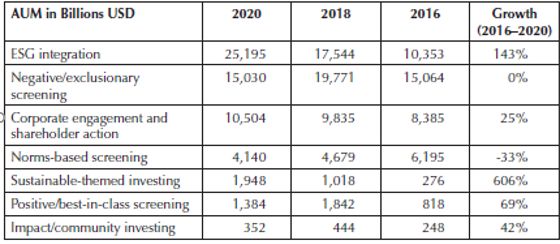

The Global Sustainable Investment Alliance has highlighted seven main ESG approaches for sustainable investing into which most sustainable investment funds fit. These are: ESG integration; negative screening; norms-based screening; positive and best-in-class screening; corporate engagement and shareholder action; sustainable-themed investing; and impact and community investing.

The ESG considerations are also increasingly being accounted for in non-listed assets, such as infrastructure, real estate and private equity, and debt. A prime motivation for this is that investors aim to align their investments with their ESG values and beliefs to minimise reputational risks and satisfy external stakeholder requirements, according to BNP’s ESG global survey.

Portfolio impact of ESG investing

Many studies, such as Harvard Business School, found “a positive correlation between sustainability and superior market performance”.

The focus of many studies has traditionally been on the quality and management of corporate governance (G) and how this “factor” can positively or negatively influence stock price performance. In line with the surge in interest in climate change mitigation and adaptation, circular economy and biodiversity issues, research has also documented a direct link between the environmental (E) performance of firms and stock price performance.

ESG controversies and their impact on stock price performance

Questionable business practices and unethical corporate behaviours are commonly considered in the evaluations used for constructing ESG ratings. However, investors can equally just focus on the ESG controversies of a particular company or sovereign. This makes sense from a portfolio performance perspective, as academic and industry research outlines that unethical and controversial business areas and practices, involving a range of material ESG issues, can have a material impact on corporates’ cost of capital as well as their share price performance. This impact can hence mean a material loss of financial value.

According to research by Bank of America, 22 controversies have wiped more than US$500 billion off the value of large US stock/listed companies since the mid to late 2010s. The research examines the impact on stock prices of companies in the S&P 500 index implicated in 24 types of controversies related to accounting scandals, data breaches, sexual harassment cases and other ESG issues. It found these companies together experienced peak-to-trough market value losses of US$534 billion as their share prices sank relative to the S&P 500 over the 12 months after the controversies were uncovered.

Key findings from various similar research undertaken:

- market reactions are much more pronounced for “bad” than “good” news flow

- firms that are subject to bad news achieve abnormal losses

- negative returns are substantially larger in magnitude for smaller cap stocks and those held by more transient investors

From theory to practice: ESG in portfolio construction

ESG investment approaches and trade-offs

ESG considerations are usually considered as investors’ beliefs that “can inform the guiding principles governing their investment decisions and activities”. However, there is an increasing amount of research pointing to the return-enhancing benefits of integrating ESG into the investment process, but there is still much debate about whether ESG can genuinely generate alpha. The lack of consensus over the alpha-generating abilities of ESG does not necessarily undermine the worth of incorporating such considerations into the investment portfolios as they may be incorporated for reasons other than purely financial.

The goal becomes to maximise financial return while satisfying investors’ non-pecuniary objectives. Running a tracking error is inevitable in ESG strategies.

Regardless of the ESG investment approach, ESG strategies tilt away from the market cap-weighted benchmark, an inevitable consequence of either excluding companies that do not meet a particular threshold or including companies that demonstrate superior ESG characteristics. It can be controlled through the process of optimisation, however, as the strategy excludes more stocks or targets a narrower subset of stocks with a strong ESG profile, and it must deviate materially from the benchmark and run a significant level of tracking error.

Strategies that claim to deliver a high level of ESG improvement at no cost should be treated with due scepticism.

This is not to say that a strategy cannot deploy portfolio management techniques to optimise the amount of tracking error it runs against the amount of ESG improvement it can attain. However, it often comes at a cost through higher transaction costs, more portfolio turnover, risks of unwanted exposures and/or substantial concentration in certain names and/or certain sectors.

Understanding different ESG strategies involving different portfolio trade-offs:

- Integration

- Screening

- Thematic investing

Thematic investing involves “top-down” stock selection, and seeks to capitalise on opportunities created by macroeconomic, geopolitical and technological trends leading to concentrated portfolios and target niche businesses. Because of this, investment capacity is often restricted, and thematic investment strategies are also likely to run a very high tracking error if measured against broad-based market cap benchmarks.

To deal with persistent biases in screening approaches, strategies can explicitly include ESG scores into the portfolio construction process by maximising the portfolio ESG portfolio score or achieving some baseline ESG improvement through portfolio optimisation.

The sources of tracking errors commonly come from a “mixed” strategy that combines excluding some “undesirable” securities and then targeting others with a strong ESG profile via optimisation. Therefore, any optimisation should keep this in mind when first considering the source and subsequently designing the process.

Portfolio management impact from corporate and sovereign controversies and risks

A study looked at the performance of companies grouped by their controversy rating, which is defined based on Sustainalytics “incident-related” indicators such as operational incidents, environmental supply chain incidents or business ethics incidents. It showed that “no-controversy”, “low controversy” and, to some extent, the “moderate-controversy” portfolios outperform the market cap-weighted benchmarks in Europe and the US, while the “high controversy” portfolio severely underperforms.

Beyond business controversies, there has also been increasing investor focus on controversies committed by governments. There is much interconnectedness between corporate and sovereign controversies as together they can cause substantial systemic ESG risks.

An example of this is the Russian invasion of Ukraine, when investors were concerned about their exposure to Russian companies because of their desire to dissociate themselves from the behaviour of the Russian government. According to Morningstar Direct, as of January 31, 2022, Russian equities made up just 0.27% of long-term European assets in funds and exchange-traded funds (ETFs), or €32.8 billion of the €12 trillion in total assets. Russia was already under international sanctions for past violations before the Ukraine war in 2022, and yet its bonds were often held in most mainstream sovereign bond funds and emerging market debt portfolios.

That being said, it would be inaccurate to suggest that only asset managers did not fully reflect sovereign risks in their investment processes. ESG ratings, on which many institutional investors depend in their asset allocation processes, do not appear to have appropriately accounted for the Russian sovereign risks either.

Is active ownership the next frontier in unlocking further ESG alpha?

Active engagement involves the use of rights and the position of ownership to influence the activities or behaviour of investee companies, and can include engagement and voting activities. Many researchers suggest that corporate engagement can be a return driver over the longer term and highlight the return-generating potential of active ownership and the impact for companies that have successfully improved their ESG practices. Industry is currently aiming to focus on applying these ambitions to (collective) sovereign engagements, which remain the “next frontier” in sustainable investing and active ownership.

ESG considerations in investment decision making

We highlight in our chapter some of the key ESG investment developments and trends that have also been summarised in a recent report by Blackrock.

Various academic and industry studies have found that sustainability can continue to affect investment returns through three interrelated channels:

- the “tectonic shift” in investor preferences that drives investment flows into sustainable assets and reduces sustainable firms’ cost of capital,

- the use of innovative data sources and fundamental research to help identify sustainable business practices and business models that could lead to excess returns compared with the broader market, and

- the evolving relationship between sustainability and traditional style factor investing.

Without a doubt, ESG’s place in investor portfolios is assured in the longer term. However, the role that ESG plays in investor portfolios remains a topic that generates huge debate. Some believe that ESG simply reflects investors’ preferences and ethics, while others believe ESG can generate alpha signals by itself.

Related to this is how mitigating controversies can impact future portfolio performance and whether they can be really identified in advance through ESG analysis or are only seen with the benefit of hindsight. We continue to monitor these developments closely and are already working on the pre-planning of our next book on “sustainable finance” implications for capital markets. Stay tuned!

You can read more about incorporating ESG considerations in the investment processes by pre-ordering the ESG Investing and Analysis: A Practitioner’s Guide. Published on 15th October 2022.

Kartik Chawla is a senior quantitative researcher at one of the biggest global asset managers with ten-plus years of industry experience.

Martina Macpherson, FICRS, PhD(c), is a ‘Top 50 Woman in Finance’ (World Finance Forum 2022), with a 20+ years career in sustainable finance, investment and index solutions. Currently, she is Head of ESG Product Management at SIX BFI, a Board Member at the Network for Sustainable Financial Markets, and a Visiting Fellow at Henley Business School.

Daniel Ung, CFA, CQF, CAIA, FRM, PhD(c), is the head of Quantitative Research and Analysis, Model Portfolio Solutions at SPDR ETFs EMEA & APAC, State Street Global Advisors. He has authored and contributed to a number of books on investment topics and is the associate editor of the Journal of Beta Investing. He completed a Master’s degree in European Business at ESCP Business School.

License and Republishing

The Choice - Republishing rules

We publish under a Creative Commons license with the following characteristics Attribution/Sharealike.

- You may not make any changes to the articles published on our site, except for dates, locations (according to the news, if necessary), and your editorial policy. The content must be reproduced and represented by the licensee as published by The Choice, without any cuts, additions, insertions, reductions, alterations or any other modifications.If changes are planned in the text, they must be made in agreement with the author before publication.

- Please make sure to cite the authors of the articles, ideally at the beginning of your republication.

- It is mandatory to cite The Choice and include a link to its homepage or the URL of thearticle. Insertion of The Choice’s logo is highly recommended.

- The sale of our articles in a separate way, in their entirety or in extracts, is not allowed , but you can publish them on pages including advertisements.

- Please request permission before republishing any of the images or pictures contained in our articles. Some of them are not available for republishing without authorization and payment. Please check the terms available in the image caption. However, it is possible to remove images or pictures used by The Choice or replace them with your own.

- Systematic and/or complete republication of the articles and content available on The Choice is prohibited.

- Republishing The Choice articles on a site whose access is entirely available by payment or by subscription is prohibited.

- For websites where access to digital content is restricted by a paywall, republication of The Choice articles, in their entirety, must be on the open access portion of those sites.

- The Choice reserves the right to enter into separate written agreements for the republication of its articles, under the non-exclusive Creative Commons licenses and with the permission of the authors. Please contact The Choice if you are interested at contact@the-choice.org.

Individual cases

Extracts: It is recommended that after republishing the first few lines or a paragraph of an article, you indicate "The entire article is available on ESCP’s media, The Choice" with a link to the article.

Citations: Citations of articles written by authors from The Choice should include a link to the URL of the authors’ article.

Translations: Translations may be considered modifications under The Choice's Creative Commons license, therefore these are not permitted without the approval of the article's author.

Modifications: Modifications are not permitted under the Creative Commons license of The Choice. However, authors may be contacted for authorization, prior to any publication, where a modification is planned. Without express consent, The Choice is not bound by any changes made to its content when republished.

Authorized connections / copyright assignment forms: Their use is not necessary as long as the republishing rules of this article are respected.

Print: The Choice articles can be republished according to the rules mentioned above, without the need to include the view counter and links in a printed version.

If you choose this option, please send an image of the republished article to The Choice team so that the author can review it.

Podcasts and videos: Videos and podcasts whose copyrights belong to The Choice are also under a Creative Commons license. Therefore, the same republishing rules apply to them.